Anti Money Laundering Digital Optimization.

StereoLOGIC Improves Operational Efficiency For AML Operations.

AML operations costs $31.5B annually.

On average, only 3-5% of all the cases the first line investigators review are valid suspects.

The key challenges AML leaders face is truly understanding how their teams are performing.

Overview

AML operations require significant investment in people and technology to maintain regulatory compliance - a proposition that is costing US and Canadian financial institutions $31.5B annually.

While the world wide estimate for laundered money is 2-5% of global GDP – or $800B to $2T USD, financial services organizations are combating this massive figure by scaling their AML operations.

Challenges

- What’s being measured?

- Are the KPIs right?

- How are people performing against them?

- How to measure Regulatory Technology performance?

- How to detect Internal Fraud?

- How to increase process efficiency targeting real suspects cases?

Solution

- Fully documented map

- Visibility into the most and least efficient processes

- Identify repetitive, low-value tasks that are candidates for Robotic Process Automation (RPA)

- Provides step by step training manuals

StereoLOGIC provides an un-paralleled 360° view – available within a few days - into your AML operations with a fully documented map of all activities across all teams. Gain visibility into the most and least efficient processes and identify best practices. Identify where manual work is and how to eliminate it, both increasing efficiency and improving the employee experience.

StereoLOGIC provides step by step training manuals that improve the onboarding and training process for new employees, and ensures that AML team members are being trained on the most effective and efficient fraud detection, investigation and escalation processes.

StereoLOGIC enables AML organizations to quickly measure the ROI of their RegTech investment with a detailed, documented map of how people and processes interact with the technology.

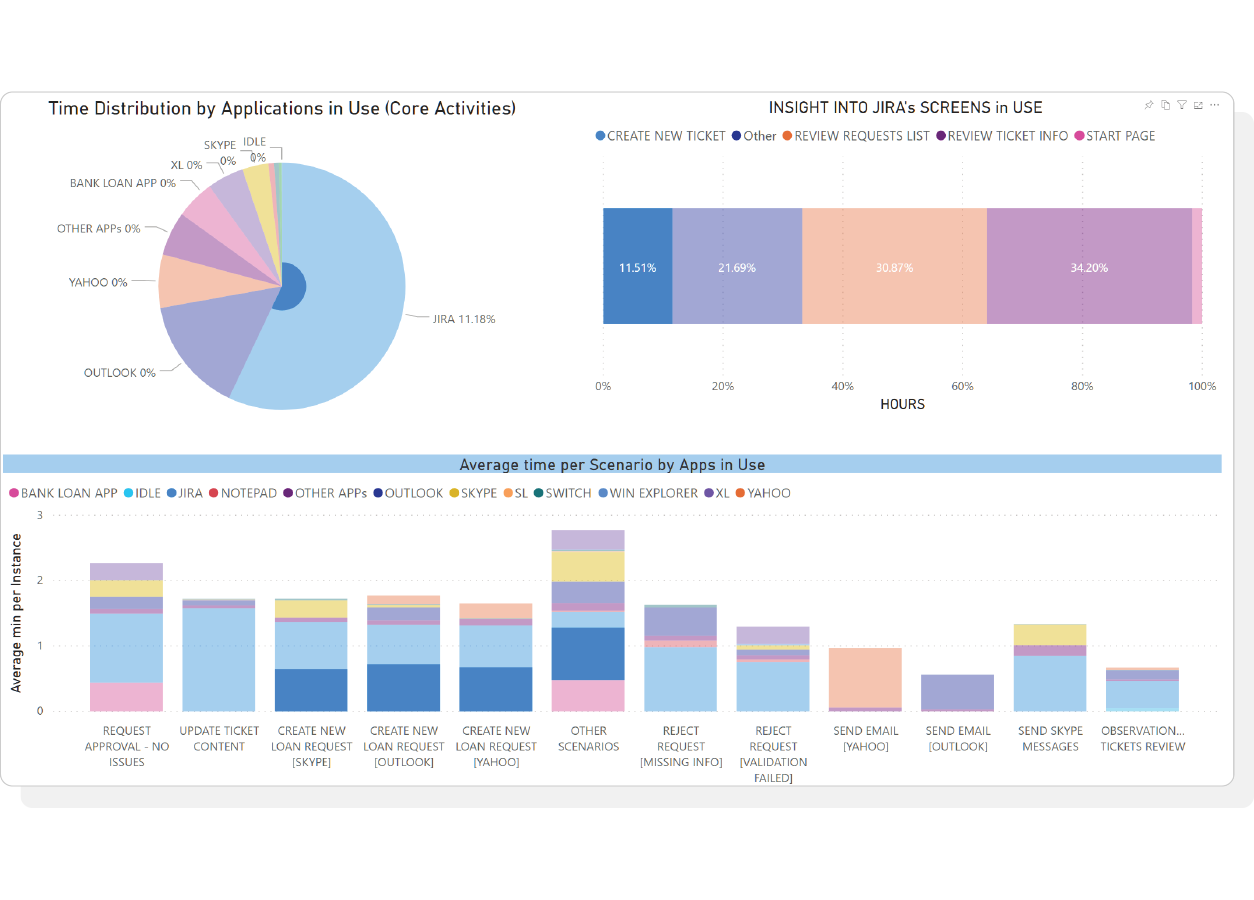

StereoLOGIC records every action on a user’s screen and provides an analysis of that activity. And, when risk is identified, it eliminates the need for specialists to document and take screen shots because the platform provides that information for every scenario.

Operational Intelligence »

The key differentiator of StereoLOGIC is its immediate adaptation to changing operational priorities and ability to provide real time answers to sudden requests.

Digital Transformation »

StereoLOGIC provides a real-time holistic view of all employee processes, tasks and systems before, during and after transformation. Reduces risk, accelerates project timelines, and insures successful results.

Robotic Process Automation »

StereoLOGIC enables your organization to achieve RPA acceleration, generating detailed process maps and documentation with UI screens for each step, which is utilized as a critical input for RPA development.

Agentic AI »

StereoLOGIC Agentic Digital Twin of Operations (ADTO) enables enterprises to implement agentic AI faster and more effectively.